IRS Name Change for Married Taxpayers

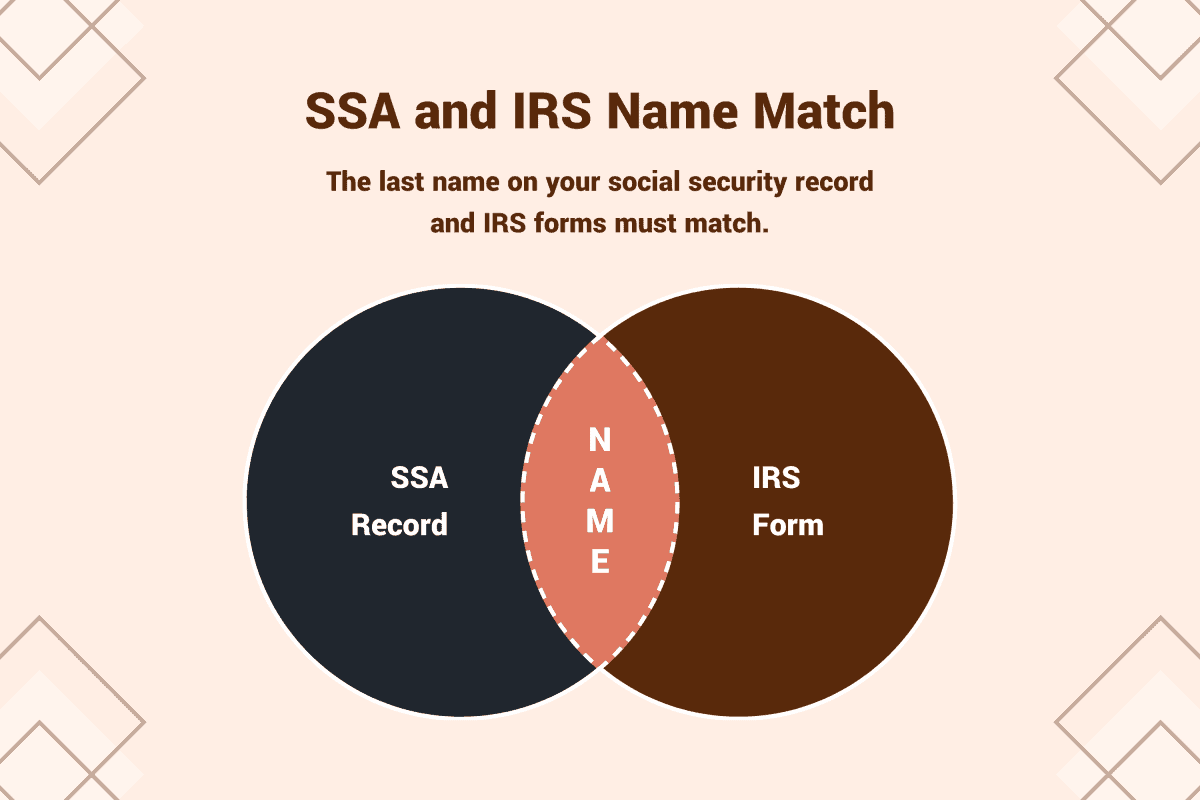

If you change your name after marriage or divorce, you must file your IRS tax return to match the name on file with the Social Security Administration (SSA) to avoid delays.

Delays could flow two ways:

- Processing your incoming tax return

- Sending your tax refund

Yet taxes and name change go beyond the SSA and IRS, extending to W-2s, 1099s, and bank accounts. You need full synchronicity, before, during, and after tax season.

This article will show you how best to complete and schedule your name change to prevent holdups, as well as taking corrective steps if something goes wrong.

The IRS heard it through the grapevine

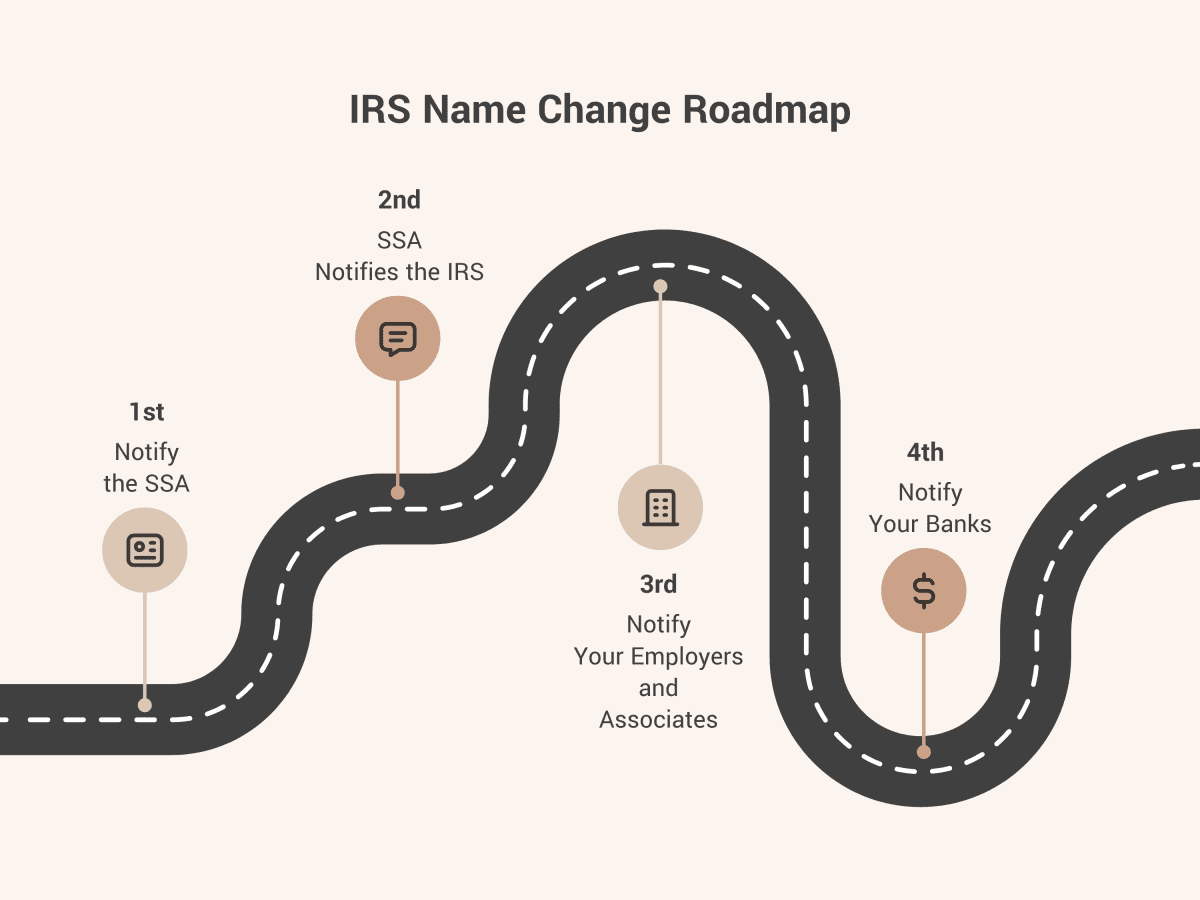

The IRS will know when your name has legally changed because the SSA will notify them after updating your social security card. This is an automatic alert.

Therefore, changing your name with the IRS starts with changing your name with the SSA. But the process does not end there—you need to warn your employers and banks too.

This SSA data exchange shares your personal information with the IRS and other federal, state, and private institutions. (And the IRS shares data right back.)

You can use our online name change program to complete your social security to IRS name change paperwork, among others.

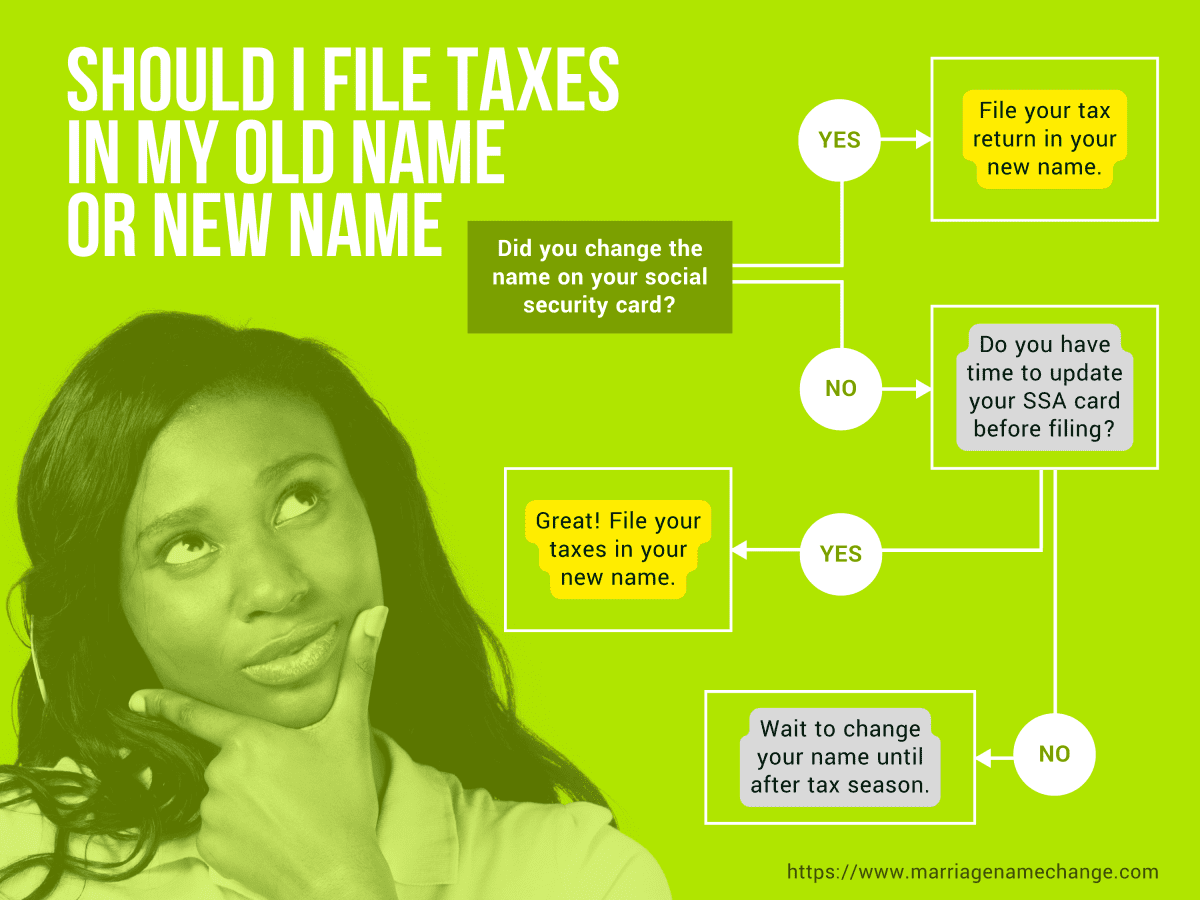

Name change before or after tax season

You should change your name before filing your tax return if you're sure your social security card, W-2s, 1099s, and bank accounts will show your new name.

Otherwise, it is safer to wait to change your name until after the IRS accepts your tax return. It's even safer to wait until after the IRS approves and deposits your tax refund.

Note: It takes 7 to 14 calendar days to get your new social security card by mail, so account for this time frame when filing your taxes.

When are taxes due this year?

Federal income taxes are due on Tuesday, April 15, 2025, at midnight, in your time zone.

The IRS will verify your name change

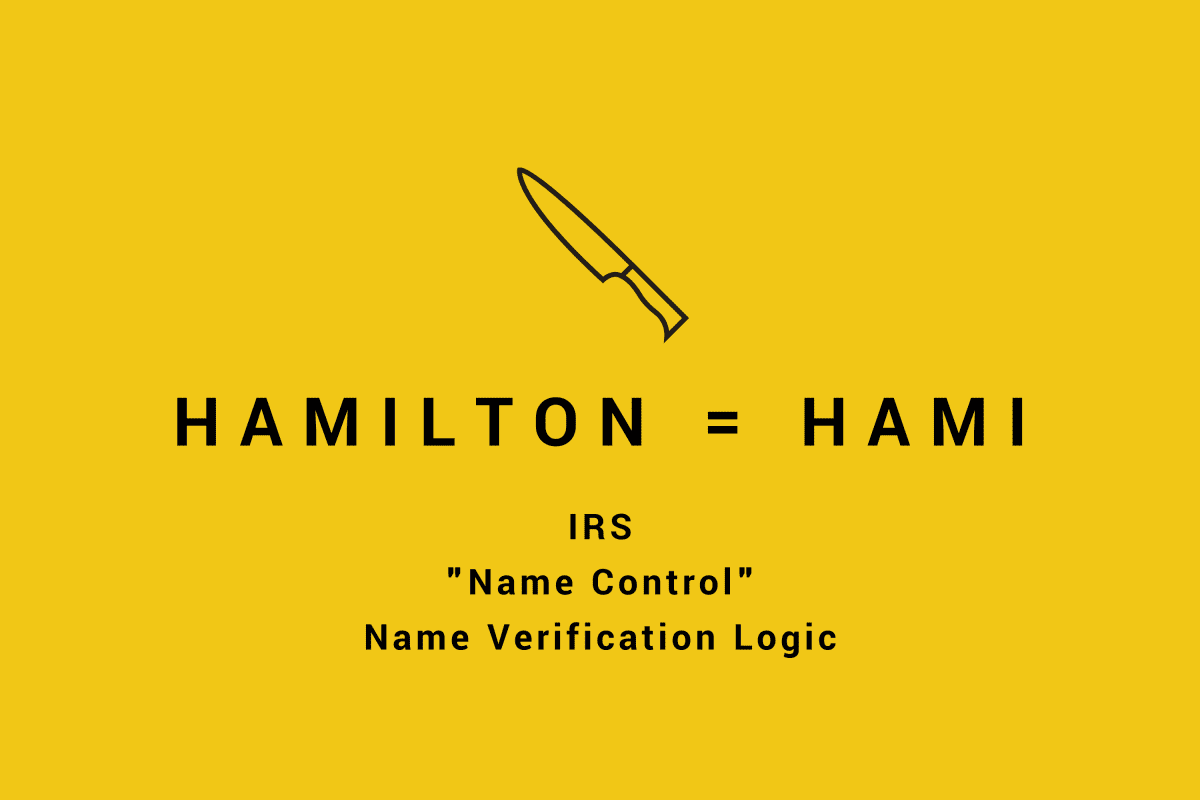

The IRS will confirm the last name on your tax return matches the last name on your social security record by running a computerized query against SSA-provided datasets.

It may surprise you that the IRS will only try to match the first four characters in your last name and not your full name.

These four characters are called the "name control." Your name control may contain letters (A-Z) and hyphens (-). (They'll strip away other characters.)

IRS name control matching is very lenient:

- For example, if your last name were Brown, your name control would be "BROW."

- Yet if you spelled your last name Browning, your name control would still be "BROW."

Your name control is used to match against your social security record along with your social security number (SSN). Mismatches can hinder processing.

These name control rules are specific to a person's name. Business names extend the above rules to allow ampersands (&), exclude the term "DBA," and ignore the word "The" when used at the start.

Advantages of e-filing and name change verification

Electronic filing (e-file) offers a key benefit over mailed paper filings: real-time name validation. If the IRS reports a name mismatch, you can try again until you fix the error.

According to the IRS, for Fiscal Year (FY) 2021, electronic filing made up 90.7% of the 148 million individual tax returns filed.

What about spouses' and dependents' names?

Social security number and last name verification apply to everyone on a tax return, including the primary taxpayer, secondary taxpayer, spouse, and dependents.

Any name discrepancy will trigger a rejection. An e-file name control mismatch error will prompt you to recheck your input data and try again.

What about accented characters?

If your name has accents or diacritical marks, file your tax return using the letter equivalent. For instance, if your surname were Gómez, spell it Gomez instead.

- Notice how the "ó" becomes "o" in Gómez.

- The name control becomes "GOME."

What about apostrophes?

It doesn't matter whether you keep or drop an apostrophe in your name on your tax return. The IRS (or your tax software) will remove it silently.

If your last name has an apostrophe, IRS computers will cut it. For instance, if your last name were O'Leary, the IRS will convert it to OLeary with a name control of "OLEA."

Unlike the IRS, SSA records allow apostrophes in last names. IRS systems account for such disparities, so this will not provoke a name mismatch.

What about short last names?

Your name control can have less than four characters, but it must start with a letter. So a last name of "Li" would cause a two-letter name control of "LI."

What about hyphenated last names?

If your name is hyphenated, the IRS will use the first four characters of your hyphenated name (including the hyphen) as your name control.

Example 1: Dangling hyphen

For instance, if your last name were Lee-Mitchell, the IRS would match against "LEE-" with the hanging hyphen as the fourth character of your name control.

Example 2: Middling hyphen with apostrophe

However, if your surname were O-D'Angelo, the IRS would use "O-DA" as the name control—keeping the hyphen yet dropping the apostrophe.

What about last names with spaces?

If your last name has a space, the IRS will remove it. For instance, if your last name were Van Hollen, the IRS will flatten it to VanHollen to achieve a name control of "VANH."

You don't have to remove spaces from your name on tax forms or your tax return. The IRS will do it during processing.

Name and address change

If your home mailing address has changed, file IRS Form 8822 and note your old and new name. Filing Form 8822 shouldn't wait until tax season—do it upon moving.

IRS-sent mail and paper tax refund checks will get lost if you don't alert the IRS of your new mailing address, which can be a home address or P.O. Box.

Employees and W-2s

Notify your employer or HR department when you change your name. The name on your W-2 must match the name on your social security record.

Your employer may need to see one proof of name change:

- Updated social security card

- Updated driver's license

- Updated passport

Or just proof of authority to change your name:

- Marriage certificate

- Divorce decree

- Court order

Filing taxes with a W-2 that's under the wrong name may lead to delays in processing your tax return and the receipt of any tax refund due.

What if your W-2 shows your old name?

If your employer issued you a W-2 under your old name, contact them for a corrected W-2 in your new name. They're required by law to comply.

Getting a corrected W-2 applies to current and former employers. If they refuse your request by the end of February, the IRS can force their hand with a Form W-2 complaint.

Accountants and employers can verify employee names and social security numbers online using the free Social Security Number Verification Service (SSNVS).

Self-employed freelancers and 1099s

If you're a self-employed freelancer, gig worker, or independent contractor, tell your associates to update your name on any IRS 1099 form issued.

If you receive a 1099 in the wrong name that doesn't match your social security record, processing of your tax return and tax refund could get delayed.

Correcting the wrong name on your 1099

he name on your 1099 must match your social security record, just like on a tax return or W-2. Otherwise, delays may occur.

1. When you find an error

If you notice the wrong name or information on your 1099, tell whoever issued it to send a corrected 1099 to you and the IRS.

2. When the IRS finds an error

If the IRS spots a mistake on your 1099, they'll alert the payer who issued it. The payer should contact you for a correction and send the updated 1099 to you and the IRS.

Update your bank account to match

You may face trouble cashing checks or receiving ACH direct deposits if the name on your check or direct deposit doesn't match the name on your bank account.

This problem goes beyond tax refund checks and direct deposits. It can affect your regular paychecks too, whether paper or direct deposit.

But your bank routing and account number is right

Here is an eleventh-hour nightmare sequence of events:

- Social security card, updated

- Employers, notified

- Clients, notified

- W-2s, done

- 1099s, done

- Tax return, done

- Name on bank account, unchanged

- Bank routing and account numbers, unchanged

Good enough, right?

- No, that's not good enough.

- You needed to tell your bank your new name.

ACH direct deposit payments may get rejected by your bank because of a name mismatch, even when your routing numbers and account numbers are correct.

Yes, that's numbers, plural, as the IRS allows you to split a tax refund direct deposit into up to three different bank accounts owned by you or your spouse.

Deposit rejection is harsh, but understandable:

- Rejection avoids depriving the true recipient of monies due.

- Rejection avoids a time-consuming investigation.

- Rejection avoids reversing a settled deposit.

- Rejection avoids IRS intervention.

You forgot to update the name on your bank account

The IRS will mail you a paper check if your bank rejects a direct deposit tax refund due to a name mismatch between the endorsed name and account holder's name.

In order to cash or deposit your incoming paper check, you must still change the name on your bank account to match the check's "pay to the order of" name.

You can use the IRS' Where's My Refund tool to check your tax refund status.

Tip: Your bank might accept a check in your old name if you present your marriage certificate, divorce decree, or whatever document prompted your name change.

Conclusion

The only thing scarier than filing your taxes is filing them in the wrong name. One name change inconsistency can invite chaos, causing tax return and refund delays.

So if you're transitioning to a new name, make sure you update it everywhere that matters—from your social security card, W-2s, and 1099s, to your bank account.

Your future self, your accountant, and the IRS will thank you.

295 Comments